Topics on options trading have been trending ever since brokers have made their services available to a wider audience. Options tend to be a lot more volatile than stocks, so hearing stories about people making millions overnight, or losing everything, has become more common.

This might scare away the average investor from options trading, even though options are securities that were designed to reduce risk while trading stocks. The goal of this article is to teach you how to properly invest in options if you are interested in adding them to your trading strategy. You won’t become a millionaire overnight, but it would be helpful to have these in your arsenal when you would like to reduce your risk.

What is Options Trading?

Options Trading is the act of buying or selling options expecting to turn a profit. Not all options carry the same amount of risk. Some options have capped risk i.e. you can only lose the amount you’ve invested. Others have uncapped risk, meaning you can lose a lot more than the amount you’ve invested.

Options are contracts based on the right, but not obligation, to buy or sell an underlying stock. This means you can essentially make a bet on whether the price of an asset will decrease or increase.

Options will have a maturity date, which is the date after which an option can no longer be exercised (American Options), or the date at which an option can be exercised (European Options). There are also Bermuda Options, which are a hybrid of American and European Options. The purchaser has the option of early exercise, but only at predefined dates. American, European, and Bermuda options are a categorization of options based on when they can be exercised.

A difference in when an option can be exercised has a significant impact on its volatility (or price fluctuation). American Options tend to be the most volatile since they can be exercised at any time before the maturity date. Bermuda Options are less volatile, and European Options are the least volatile. However, this is only one of the factors defining volatility. A more important predictor of option volatility is the volatility of the underlying asset.

There are many types of options, but we’ll focus on the most common ones available to the average investor for simplicity’s sake, Put Options and Call Options.

Put Options

These types of options give the purchaser the right to sell the underlying stock to the seller of the option for a specified price (the Strike Price) at a future point in time (the Exercise Date).

Put Options are purchased when the buyer thinks that the underlying stock’s price will decline below the strike price in the future, or sold when a seller thinks the price will increase above the strike price in the future.

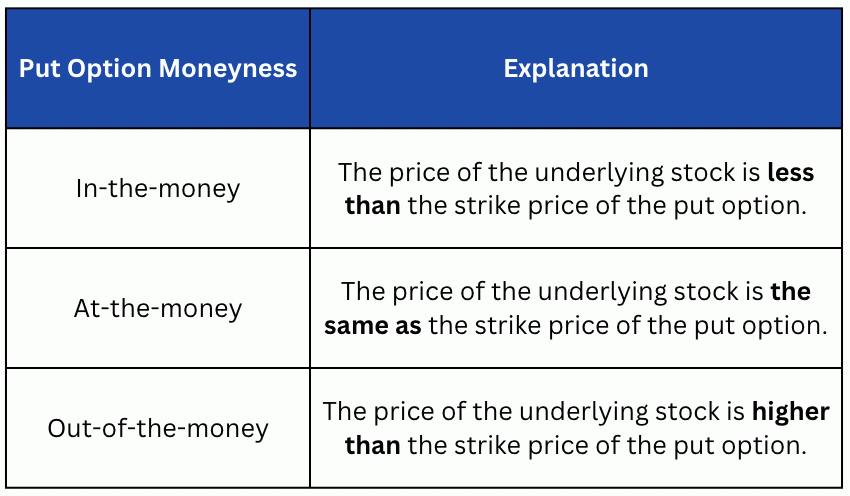

The Moneyness of a Put Option is defined by one of three states, explained in the table below:

If a put option is in-the-money, the buyer will choose to exercise the option. The buyer will buy the underlying asset at market price, and sell it to the seller for the option at the higher strike price. The buyer’s profit is the difference between the strike price and the market price of the stock at exercise minus the premium paid for the option. The seller’s loss is capped since the price of the stock can not fall below zero. This is even if the stock becomes worthless at the time of exercise.

If a put option is out-of-the-money, the buyer will choose not to exercise the stock, since no profit can be made. The buyer’s loss is capped at the premium paid for the option. The seller’s gain is the premium received.

Call Options

These types of options give the purchaser the right to buy the underlying stock from the seller of the option for a specified price (the Strike Price) at a future point in time (the Exercise Date).

Call Options are purchased when the buyer thinks that the underlying stock’s price will increase above the strike price in the future, or sold when a seller thinks the price will decrease below the strike price in the future.

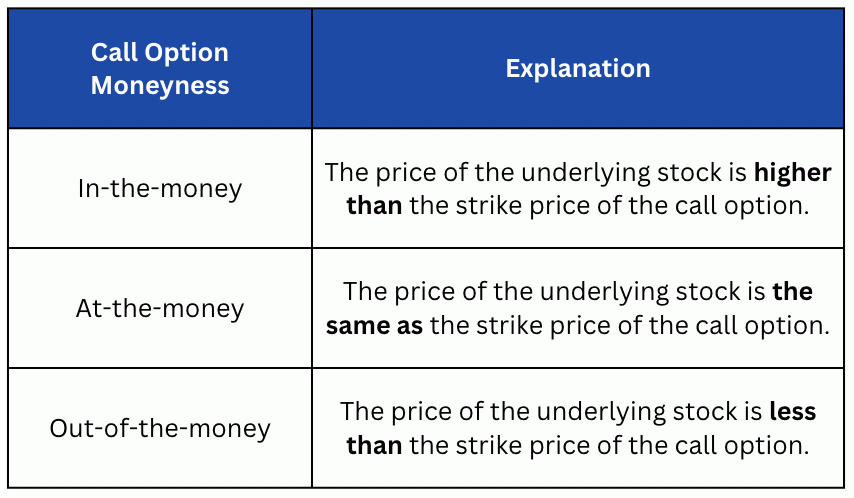

The Moneyness of a Call Option is defined by one of three states, explained in the table below:

If a call option is in-the-money, the buyer will choose to exercise the option by buying the underlying stock for the lower strike price and selling it for the higher market price. The buyer’s profit is the price of the underlying stock above the strike price minus the premium paid for the option. The seller’s loss is uncapped, as there is no upper limit on the price of the stock.

If a call option is out-of-the-money, the buyer will not exercise the option since no profit can be made. The buyer’s loss is capped at the premium paid for the option. The seller’s gain is the premium received.

How to Trade Options?

Options can be traded using a broker that supports options trading. We have written about two low-fee brokers in the US and Canada in our article on how to buy stocks in the US and Canada.

Before you engage in options trading you need to analyze the underlying stock. The article above also mentions how you can use simplywall.st to analyze underlying stocks. You’ll also need to keep up to date on financial news regarding the stock you are interested in trading options for. Once you are well informed, you are ready to take a position.

Taking a long position means you are buying an option. On the other hand, taking a short position means you are selling an option. One important thing to note about trading options is that you don’t only need to be right about the price movement, but also the timing. In the next section, we’re going to discuss some popular options trading strategies.

Options Trading Strategies

Generally, options should be used to decrease risk in your portfolio. The Options Playbook is a great free resource to learn about 40 different options trading strategies.

Learning about different strategies and when to use them can help you add stocks to your portfolio at a more optimal price when taking options premiums into account. It could also limit your potential loss in case a bet doesn’t go the way you expect it to.

We’ll be posting about options strategies in more detail in our coming articles. Subscribe to our blog to learn about the latest posts and updates so you can maximize your gains while minimizing risk.

Disclaimer: The information provided is for general informational purposes only and should not be considered as professional financial advice. The content is not tailored to any individual’s financial situation or investment objectives. Before making any financial decisions, it is recommended to consult with a qualified financial advisor who can provide personalized advice based on your specific circumstances. Any reliance on the information provided herein is at your own risk. The content may not be up-to-date, and we do not guarantee its accuracy. Investing in financial markets involves risk, and past performance is not indicative of future results. We disclaim any liability for any financial loss or damage arising from the use of the information provided. Always conduct thorough research and consider seeking professional advice before making any financial decisions. Additionally, some of the links in this article may be affiliate links, which may provide compensation to us at no cost to you, if you decide to sign up. Our policy with affiliate links is that we do not promote any service that we feel does not provide value to our readers.